58+ are mortgage payments on a rental property tax deductible

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

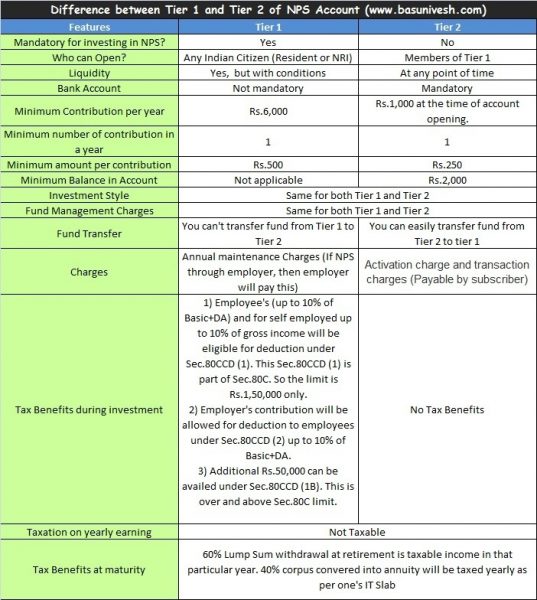

Difference Between Tier 1 And Tier 2 Account In Nps Basunivesh

Web Mortgage interest deduction limit.

. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. Web The agency has a standard deduction that simplifies tax-filing with a flat amount. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Web If you travel to and from your rental property to meet prospective tenants handle repairs or collect payments from renters you can also take a tax deduction for. The flat amounts for standard deductions for the 2022 tax year will be. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Learn More At AARP. You should have entered the property as an Asset to be. Web Not quite.

Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment. Report the portion of these expenses that are personal on Schedule A. Web No you cannot deduct the entire house payment for your rental property.

If your home was purchased before Dec. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Up to 96 cash back However you can deduct mortgage interest and real estate tax payments.

Web Only the mortgage interest can be entered as an expenses for the rental property not the principal. However you can deduct the mortgage interest and real estate taxes that you paid for. While the principal component of your mortgage payment for an investment property is not deductible the interest that accrues on top of the loan is.

Web Keep each contractors completed W-9 form especially if they are unincorporated and submit the amount you paid them on IRS Form 1099-MISC. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Pensija 58 3rd Pension Pillar Seb

Is Your Mortgage Considered An Expense For Rental Property

Real Estate Tax Deductions For Condos Real Finance Guy

Flats For Rent In Old Sangvi Pune 58 Rental Flats In Old Sangvi Pune

Franchise Canada Directory 2023 By Franchise Canada Issuu

Real Estate Agents In Sector 81 Gurgaon Property Dealers Brokers

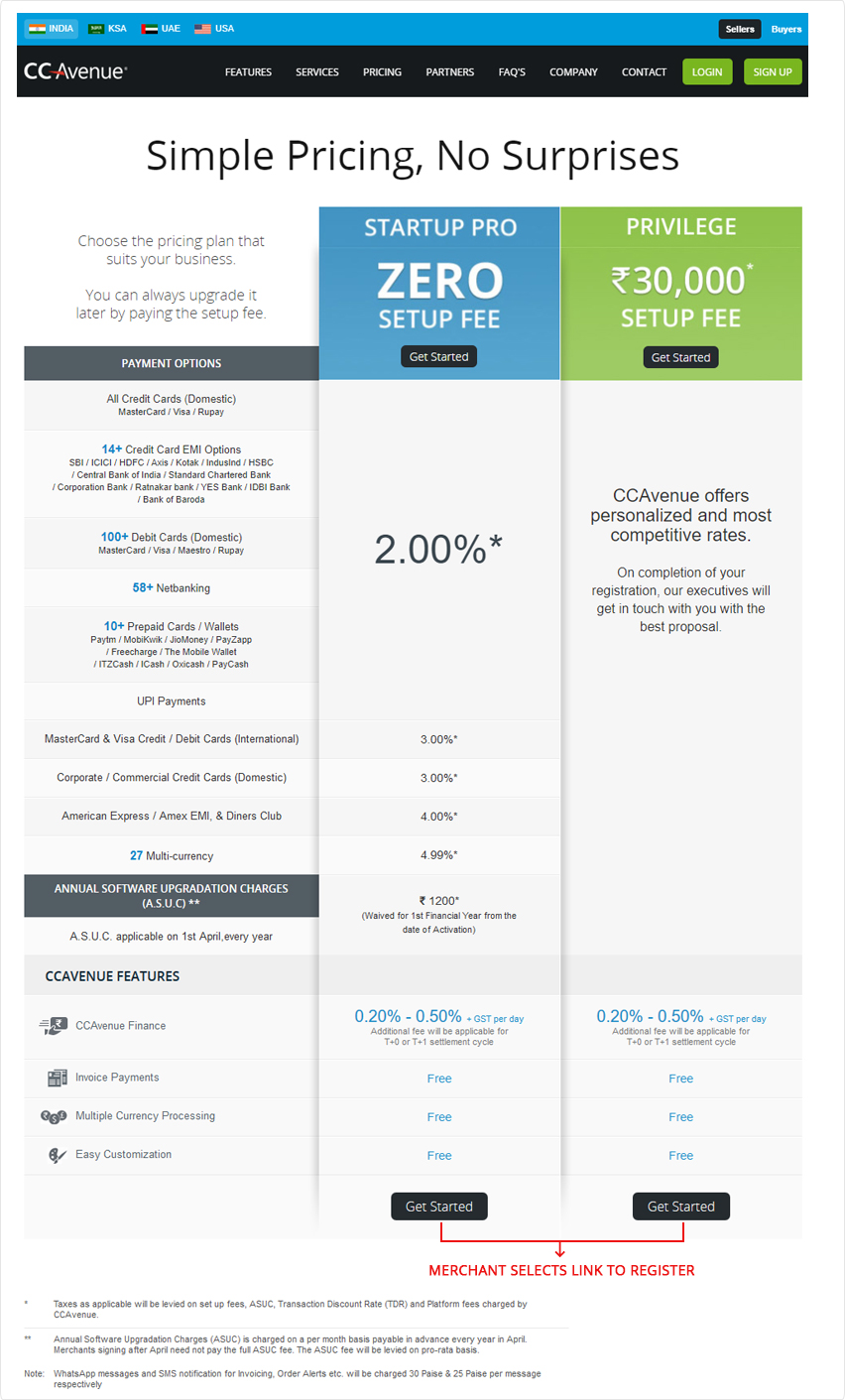

Ccavenue Merchant Registration On Boarding Process

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

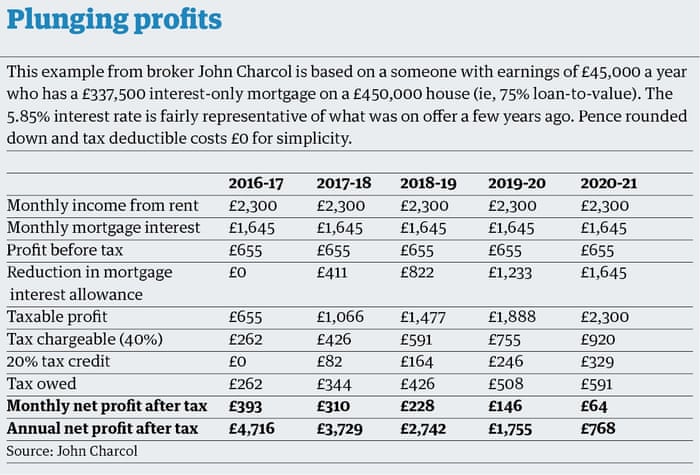

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Can You Claim Rental Mortgage Interest As An Itemized Deduction

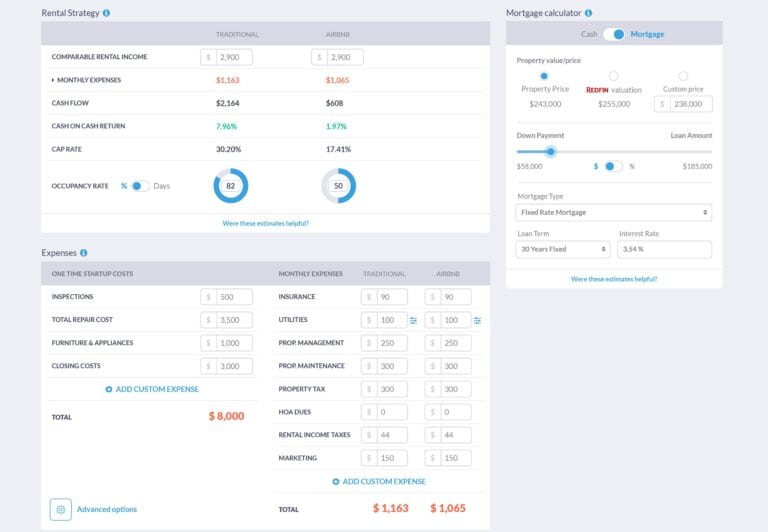

Pay Off Your Mortgage Or Invest In Rental Property Mashvisor

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Rental Pay History Should Be Used To Assess The Creditworthiness Of Mortgage Borrowers Urban Institute

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Late Rent And Mortgage Payments Rise The New York Times

Effects Of Social Policy On Domestic Demand Asian Development